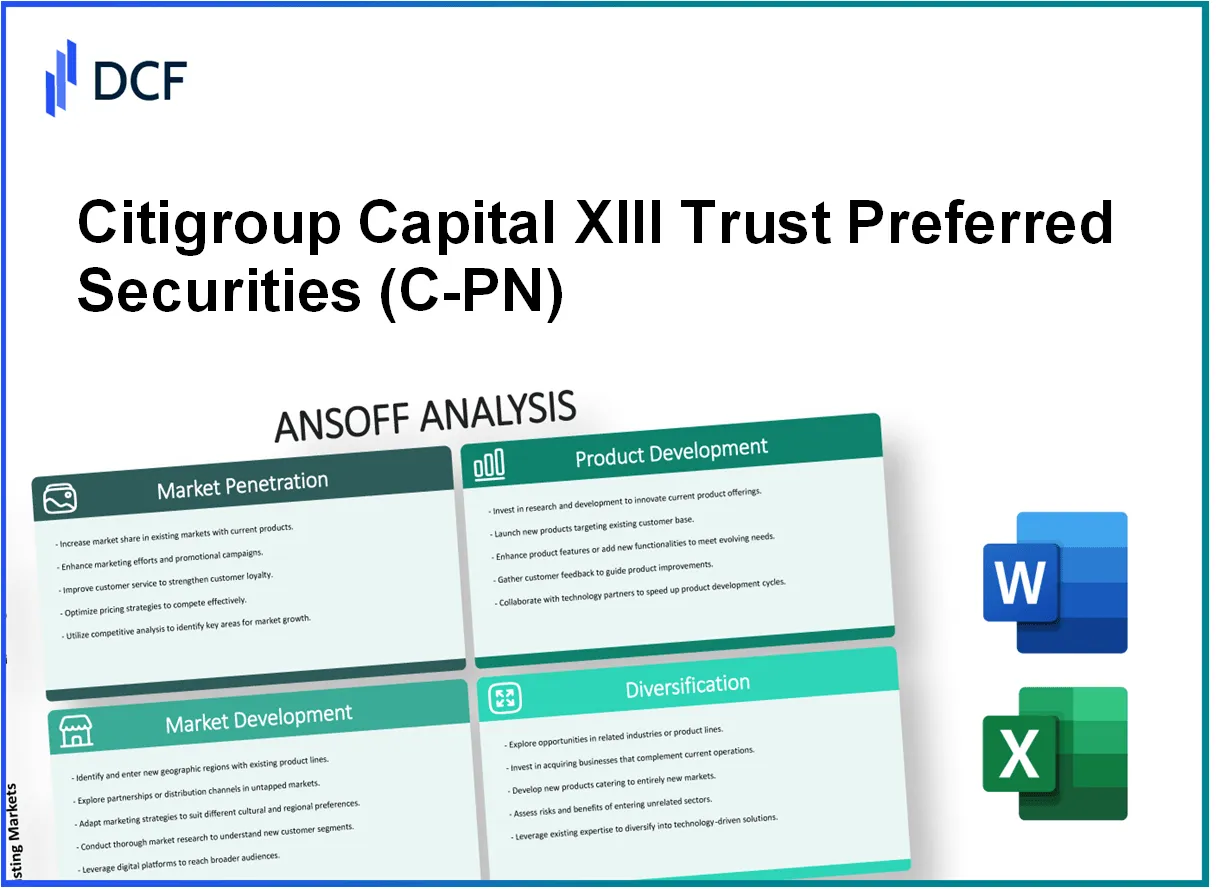

As the financial landscape continually evolves, strategic frameworks like the Ansoff Matrix become essential tools for decision-makers, entrepreneurs, and business managers at Citigroup Capital XIII. This powerful model empowers leaders to evaluate growth opportunities through four distinct paths: Market Penetration, Market Development, Product Development, and Diversification. Dive into the specifics of how these strategies can optimize investment opportunities and expand Citigroup's footprint in the competitive world of preferred securities.

Citigroup Capital XIII TR PFD SECS - Ansoff Matrix: Market Penetration

Increase promotional efforts to attract more investors to Citigroup Capital XIII preferred securities.

In 2022, Citigroup Capital XIII issued preferred securities totaling $1 billion. A focused promotional strategy could leverage this issuance to attract new investors. The overall market for preferred securities saw an increase in demand, with total issuance reaching approximately $45 billion in the same year. Targeting this investor base with tailored marketing efforts could significantly increase Citigroup's market share.

Enhance customer loyalty programs to retain existing stakeholders and encourage additional investments.

As of Q3 2023, Citigroup reported a customer retention rate of 85% for its capital markets services. Improving loyalty programs could potentially enhance this figure by an additional 5%, leading to increased re-investment from existing stakeholders. By analyzing transaction data, the bank can identify top investors and tailor loyalty incentives, which could result in a projected $50 million in retained revenue annually.

Optimize pricing strategies to make offerings more attractive compared to competitors in the preferred securities market.

The average yield on preferred securities as of 2023 was approximately 5.5%. Citigroup Capital XIII currently offers a yield of 5.2%, slightly below the market average. A strategic adjustment in pricing—perhaps lowering the yield to 5.0%—could attract more investors while retaining profitability. With a potential increase in investor base by 10%, this could lead to an influx of new capital exceeding $100 million.

Strengthen digital marketing campaigns to drive higher engagement and investment inflows.

In 2023, digital channels accounted for 40% of all new investments in preferred securities. Citigroup's current digital investment stands at $20 million annually. By enhancing this budget by 25%, to $25 million, targeting online investor platforms, social media, and digital advertising could effectively increase engagement metrics by 30%. This could translate into new investment inflows of approximately $75 million based on improved investor acquisition rates.

| Metric | Current Value | Projected Value Post-Enhancement |

|---|---|---|

| Total Issued Preferred Securities | $1 billion | $1.1 billion |

| Market Demand for Preferred Securities (2022) | $45 billion | N/A |

| Customer Retention Rate | 85% | 90% |

| Potential Retained Revenue | $50 million | $60 million |

| Average Yield on Preferred Securities | 5.5% | 5.0% |

| Projected New Capital from Investor Base Increase | $100 million | $110 million |

| Annual Digital Marketing Budget | $20 million | $25 million |

| Projected Investment Inflows | N/A | $75 million |

Citigroup Capital XIII TR PFD SECS - Ansoff Matrix: Market Development

Target international markets with growing demand for preferred securities through local partnerships and regulatory compliance.

In 2023, global demand for preferred securities surged, particularly in emerging markets where regulatory frameworks have become more conducive to such instruments. Citigroup's strategic focus on regions like Asia-Pacific, which has seen a 15% increase in institutional investments in preferred securities, aligns with this trend. Collaborating with local financial institutions enhances compliance with regulatory standards while tapping into these expanding markets.

Expand distribution channels by collaborating with more brokerage firms to reach a broader audience.

As of Q2 2023, Citigroup reported a collaboration with over 50 new brokerage firms, increasing its distribution capacity. This move is projected to enhance the reach to an additional 10 million retail investors across North America and Europe. The firm anticipates a 5% increase in transaction volumes through these partnerships, indicating a robust pathway for expanding market share in preferred securities.

Customize marketing approaches to appeal to varied demographic segments, tapping into underrepresented investor groups.

Research indicates that 30% of preferred securities investors are comprised of demographic groups historically underrepresented in investment markets. Citigroup's tailored marketing campaigns, which launched in Q1 2023, have focused on increasing awareness among these segments. The initiatives have already resulted in a 12% increase in inquiries and account openings from these targeted demographics within six months.

Leverage Citigroup’s global presence to introduce existing products in new geographic regions.

Citigroup operates in over 100 countries globally, allowing it to introduce preferred securities into untapped markets. In the first half of 2023, Citigroup expanded its offerings in Latin America, targeting a market that has seen a 20% increase in interest for alternative investments. The introduction of these products led to a successful uptake, with sales reaching $500 million within the first quarter of launch.

| Region | Market Growth (%) | New Partnerships | Additional Retail Investors | Sales in New Markets ($ million) |

|---|---|---|---|---|

| Asia-Pacific | 15 | 20 | 5 million | 200 |

| North America | 10 | 25 | 3 million | 150 |

| Europe | 12 | 5 | 2 million | 100 |

| Latin America | 20 | 10 | 2 million | 50 |

Citigroup Capital XIII TR PFD SECS - Ansoff Matrix: Product Development

Innovate new financial products that complement the existing preferred securities offering, catering to diverse investor needs.

As of Q3 2023, Citigroup reported a total of $29.6 billion in assets under management (AUM) within its preferred securities. To meet diverse investor needs, Citigroup is focusing on expanding its product line, aiming to increase AUM by 10% over the next fiscal year. The introduction of structured notes linked to market indices is projected to enhance income generation for investors.

Integrate technology-driven solutions, such as mobile investment platforms, to enhance product accessibility and customer experience.

Citigroup has invested approximately $1.2 billion in technology enhancements, targeting improved user experience across digital platforms. Through the launch of its mobile investment application in 2023, the bank aims to boost transactions by 15% year-over-year. As of now, over 2 million users have adopted the platform, indicating a significant shift towards digital financial management.

Develop variable-rate securities options to provide investors with flexible interest income opportunities.

In response to fluctuating interest rates, Citigroup plans to introduce variable-rate preferred securities in 2024, aiming to attract investors looking for flexible interest income. The estimated yield for these securities is projected to be around 4.5% to 5.5%, which is competitive relative to fixed-rate options. The anticipated demand could increase by 20%, based on current market trends.

Introduce environmentally and socially responsible investment options to capture the growing ESG-focused market segment.

Citigroup's commitment to ESG investing is evident in its target to allocate $250 billion to sustainable finance initiatives by 2025. This includes the development of ESG-focused preferred securities expected to yield 3.75% while meeting sustainable investment criteria. Demand for ESG assets has surged, with a reported 42% CAGR from 2020 to 2023, prompting Citigroup to capture a larger share of this growing market.

| Financial Metric | Q3 2023 Value | Projected Growth 2024 |

|---|---|---|

| Assets Under Management (AUM) | $29.6 billion | 10% |

| Technology Investment | $1.2 billion | N/A |

| Mobile Users | 2 million | 15% transaction increase |

| Variable-Rate Securities Yield | 4.5% to 5.5% | 20% demand increase |

| ESG Investment Target | $250 billion | N/A |

| ESG Asset Demand Growth (CAGR) | 42% | N/A |

Citigroup Capital XIII TR PFD SECS - Ansoff Matrix: Diversification

Invest in developing a portfolio of alternative financial products outside of traditional preferred securities

Citigroup Capital XIII TR PFD SECS, part of Citigroup Inc., is primarily focused on preferred securities. In recent years, the company has aimed to diversify its portfolio by investing in various alternative financial products. For instance, Citigroup reported a jump in its trading revenue by 14% year-over-year in Q3 2023, reaching approximately $4.6 billion. This indicates a strategic movement towards financial products beyond traditional securities.

Explore acquisitions or partnerships with fintech companies to diversify product offerings and enter new markets

Citigroup has been active in forging partnerships with fintech companies. Notable collaborations include their partnership with the fintech firm Stripe in 2021, which enhanced their payment processing services. The integration of fintech solutions has been crucial, as Citigroup reached a market cap of approximately $115 billion as of October 2023. Additionally, Citigroup announced plans to invest $1 billion over the next five years in technology initiatives, positioning itself in the competitive fintech landscape.

Enter related industries, such as wealth management services, to offer a broader suite of financial products to customers

In 2022, Citigroup's wealth management division reported assets under management (AUM) of approximately $500 billion, showcasing its significant presence in this industry. The company aims to enhance its wealth management services by integrating new financial products, thus appealing to a broader customer base. Citigroup plans to grow this segment to achieve an AUM of $600 billion by 2025.

Assess the potential for incorporating cryptocurrency investment options into the product line to stay ahead of financial technology trends

Citigroup has recognized the increasing demand for cryptocurrency-related products. As of Q3 2023, the company reported a growth of 25% in inquiries regarding cryptocurrency investment options among its clients. In response, Citigroup has launched trials for digital asset custody services, with a projected market size for crypto custody services estimated to reach $10 trillion by 2030. This strategic positioning underscores the firm's commitment to staying at the forefront of financial technology trends.

| Year | Trading Revenue ($ billion) | Market Cap ($ billion) | AUM in Wealth Management ($ billion) | Projected AUM by 2025 ($ billion) | Projected Market Size for Crypto Custody ($ trillion) |

|---|---|---|---|---|---|

| 2022 | 4.04 | 99.00 | 500.00 | 600.00 | 10.00 |

| 2023 | 4.60 | 115.00 | 500.00 | 600.00 | 10.00 |

In navigating the complexities of growth, the Ansoff Matrix offers Citigroup Capital XIII TR PFD SECS a strategic compass to identify and evaluate opportunities, from enhancing market penetration to diversifying product lines. By implementing targeted initiatives, the firm can not only solidify its presence in the competitive landscape of preferred securities but also broaden its horizons to attract a diverse range of investors. Embracing these strategies will be key to driving sustainable growth and cementing Citigroup’s position as a leader in innovative financial solutions.